Report: Office space in Poland 2019

AXI IMMO Office report: The office market in Poland is constantly growing, the total stock of modern office space in the H₁ 2019 exceeded 10 million sq m. ...

| REPORT Office space in Poland 2019 – Polish cites office destinations Download for free PDF | 3,54 MB |

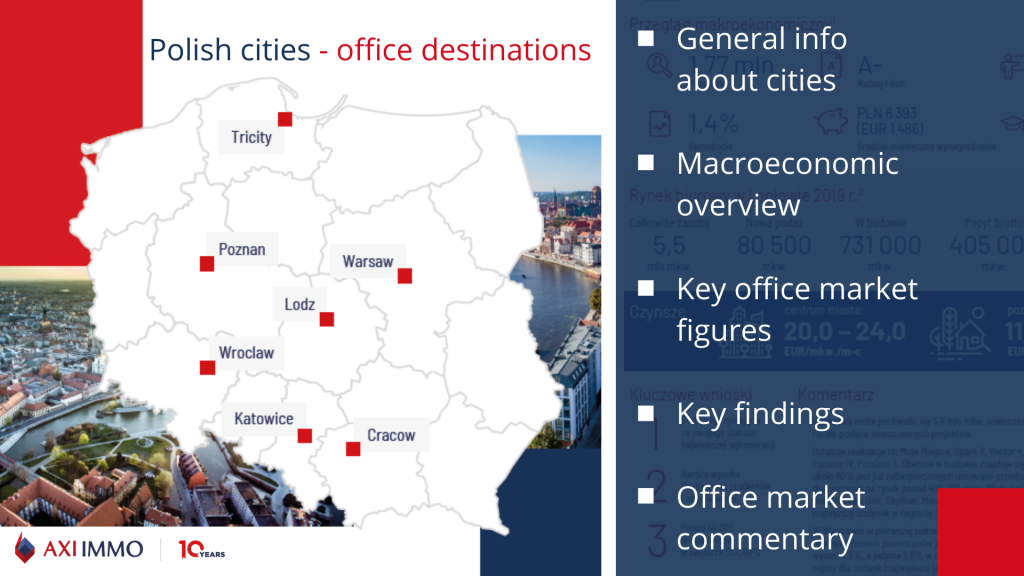

Polish cities – office destination

The office market in Poland is constantly growing, the total stock of modern office space in the H₁ 2019 exceeded 10 million sq m. Although the capital is still leading in terms of demand for office space, which in the first half of this year amounted to just over 400,000 sq m in this city, regional markets are also gaining in importance.

Cracow and Wroclaw are office locations that can boast over 1 mln sq m of modern office space. Demand for offices in six main locations except Warsaw was 292,500 sq m. The demand for offices from investors site means that developers are very active throughout the country, which is reflected in the constantly growing supply not only in Warsaw but also on regional markets.

In the H₁ 2019, more office space was delivered in Cracow, Wrocław and the Tri-City than on the capital market, in each of these cities the new supply amounted to over 90,000 sq m. Currently, the most space under construction is in Katowice (250,000 sq m), Wroclaw (210,000 sq m) and Cracow (190,000 sq m). In Warsaw under construction is over 730,000 sq m of modern space.

Warsaw

Warsaw

- Warsaw is the country’s largest business centre and the largest office market in Poland. The stock of modern office space is 5.5 mln sq m.

- The financial and insurance sectors, as well as companies from the IT sector, have had the largest share in demand for several years. In addition, the city has recently attracted large numbers of coworking companies that lease a significant part of space in newly emerging projects.

- The vacancy is at its lowest level since 2012 currently at 8.5%, with only 5.6% in the city centre.

- In 2020 can see over 400,000 sq m scheduled to be delivered. Many of these are office towers: The Warsaw Hub, The Unit, Skyliner and Varso (the tallest building in CEE).

Cracow

Cracow

- Cracow is the second largest office market in Poland. Over the past ten years, the city’s office space resources have increased almost four times, which has made this city the most dynamically developing regional market.

- Currently, Cracow is a leader among regions, where is the most office space under construction.

- Take up in 2017 and 2018 was at 150,000 sq m p.a. This year can be better because in H₁ 2019 demand exceeded 135,000 sq m.

- 60% of modern office space in this city

- Almost 60% of modern office space in this city is occupied by the modern business services sector, employing 70,000 employees.

Wroclaw

Wroclaw

- Currently, Wroclaw is the third largest office market in Poland and offers over 10% of the office space available nationwide.

- The total stock of office space in this city exceeded 1,07 mln sq m.

- Wrocław is in the third position in terms of the number of shared services centres, right after Warsaw and Cracow.

Tri-City

Tri-City

- The Tri-city is the fourth largest office market in Poland, right after Warsaw, Cracow and Wroclaw.

- Tri-city will break 1 mln sq m of modern office space within this year. Almost 100,000 sq m were added to the market in the last 18 months.

- Tri-city for office location is very often chosen by companies from the SSC / BPO and IT industries. The market largely owes its position to Scandinavian companies, which invest intensively here, including due to convenient air connections with the Tri-City.

- The city is the 2nd most attractive destination for relocation in Poland.

Katowice

Katowice

- Katowice is in the fifth position on the office market in Poland. The total stock of nearly 530,000 sq m.

- In 2017 and 2018, demand amounted to over 30,000 sq m. The year 2019 promises to be record-breaking because the same number of sq m has already been rented in the first half of the year.

- The vacancy rate has been decreasing since 2016, currently at 7.5%.

Poznan

Poznan

- Poznan ranks sixth among office markets in Poland, after Warsaw, CraCow, Wroclaw, the Tri-City and Katowice.

- Unfortunately, tenants in the last two years have been struggling with the low availability of modern office space due to the limited supply of new projects. This year situation will change, as more than 90,000 sq m are expected to hit the market.

- Thanks to investors’ activities, Poznan has become a modern centre of services and advanced production.

Lodz

Lodz

- Lodz is becoming one of the most dynamically developing major regional markets in Poland.

- By the end of 2022, modern office space in the city may increase by almost 50%.

- Lodz stands out from other Polish cities with many factories and tenements, which are increasingly adapted to modern and unconventional office space in the city. In such facilities in the first half of 2019, as much as 20% of the space delivered to the market was created in this way.

Do you want to learn more? Download the report.

Read also the report for the warehouse market in Poland: Report – Polish Warehouse Market in Q1 2021

Recent articles

15 April 2024

UNIQ LOGISTIC stays in Kutno, AXI IMMO real estate agency advises

UNIQ LOGISTIC stays in Kutno, central Poland, in the Kutno Logistics Centre. The tenant was advised by AXI IMMO

27 March 2024

MR D.I.Y. advised by AXI IMMO rents a warehouse at Hillwood Zgierz I, Central Poland

Almost 5,000 sq m for the logistics headquarters of MR D.I.Y. in Central Poland

12 March 2024

The latest AXI IMMO report: Industrial Market in Poland 2023

The Industrial market in Poland in 2023 – slower, but not weaker

4 March 2024

Chemart International Trader occupies another 150% of warehouse space in Tri-City, Poland

AXI IMMO again advises Chemart International Trader in northern Poland