Grosvenor, IO and REINO Capital investment vehicle acquires prime logistics park in Poland

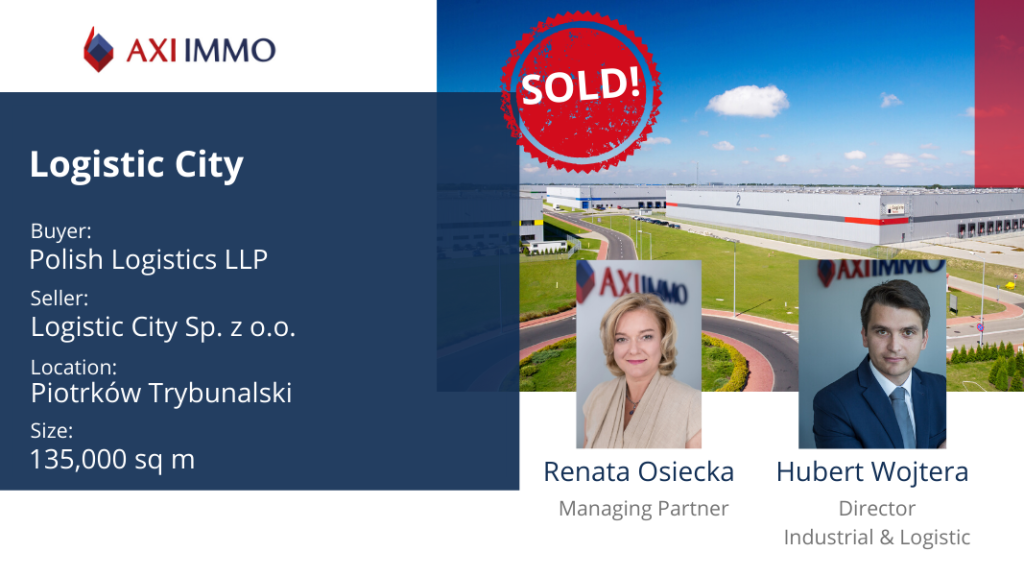

AXI IMMO advises the vendor on the sale of the Logistic City logistics park in Piotrków Trybunalski.

Polish Logistics, a new investment vehicle established by IO Asset Management, the specialist manager of industrial real estate, and REINO Capital, a real estate holding company listed on the Warsaw Stock Exchange, with the backing of Grosvenor Group, has completed its first investment, a prime logistics park in the centre of Poland.

The Logistic City comprises 135,000 sq m of built and leased space and development land, with the potential for a further 300,000 sq m of build-to-suit space. The built space comprises four units, let to seven tenants. The main tenant, occupying half of the space, is Jysk, the Danish retail chain.

Polish Logistics was advised by Savills and Linklaters and the vendor was advised by AXI IMMO.

“Usually, the bulk of logistics investment transactions in Poland are portfolio deals. However, in the case of the Logistic City transaction in Piotrków Trybunalski the key element was the potential of that particular logistics center. The park will offer a total of over 400,000 sq m, which will allow the buyer to grow comfortably on the local market. Once again, the Polish industrial market proved to have huge investment potential”. – comments Renata Osiecka, Managing Director, AXI IMMO.

Attractive warehouse market

The Polish Logistics LLP investment vehicle will be managed by REINO IO Logistics, a joint venture that draws upon REINO’s local market presence and IO’s specialist industrial real estate expertise.

Polish Logistics LLP intends to expand its portfolio through the acquisition of both standing investments and land for build-to-suit developments. It represents the third investment program for IO Asset Management and Grosvenor. The first two were multi-let industrial assets in the UK.

The joint venture partners consider Logistic City to be a superb first investment, as it is located in an increasingly desirable area for central distribution hubs, and there is the potential for further development to meet the growing demand from logistics users.

Angus Scott-Brown, managing partner of IO Asset Management, says: “‘The logistics market in Poland is particularly attractive due to its location, size, and growth potential. It is a natural direction of development for both IO and our investors. The joint venture with REINO Capital is an excellent combination of experience and local competences, which are essential for the acquisition of new investment opportunities and the delivery of value to our investors.”.

Dorota Latkowska, CIO of REINO Partners, the asset management company of REINO Capital, said: “The fact that we have attracted Grosvenor for its first investment in Poland is evidence of its recognition and trust in our team. REINO, having a 10-year track record, is becoming a first-choice investment partner and asset manager in the Polish real estate market for global investors”.

“We want to make Logistic City and its expansion the foundation of our logistics investment program in Poland. We are ready to significantly expand our logistics portfolio within the coming months, as we have identified several investment opportunities”.

Andy Yates, Investment Director, Indirect Investment, at Grosvenor Group, said: “We are pleased to have made this first acquisition in our new venture. Whilst this is the first partnership with REINO, it is our third partnership with IO, and we believe the combination of local market knowledge and sector expertise is very powerful. We look forward to building on this initial investment in what is a sector with strong supporting market dynamics.”

“The strong investor demand for Polish industrial assets is mainly due to our position in the Central and Eastern Europe region, high occupier demand, rapid development of the e-commerce sector, as well as ongoing investments in road infrastructure. Congratulations to both the seller and the buyer of the park located in the hottest warehouse region in Poland,” adds Hubert Wojtera, Director, Industrial & Logistics Agency, AXI IMMO.

The new Polish Logistics LLP investment platform

REINO Capital Group is a stock exchange holding company composed of companies operating on the commercial real estate market.

IO Asset Management is a company founded in 1986 as an industrial ownership company. IO Asset Management specializes in industrial asset management. IO is a private investment management company on behalf of external investors, such as the Grosvenor Group and Tesco Pension Fund.

The Grosvenor Group is a private company operating in the global real estate market. Manages GBP 11.9 billion in assets.

Recent articles

15 April 2024

UNIQ LOGISTIC stays in Kutno, AXI IMMO real estate agency advises

UNIQ LOGISTIC stays in Kutno, central Poland, in the Kutno Logistics Centre. The tenant was advised by AXI IMMO

27 March 2024

MR D.I.Y. advised by AXI IMMO rents a warehouse at Hillwood Zgierz I, Central Poland

Almost 5,000 sq m for the logistics headquarters of MR D.I.Y. in Central Poland

12 March 2024

The latest AXI IMMO report: Industrial Market in Poland 2023

The Industrial market in Poland in 2023 – slower, but not weaker

4 March 2024

Chemart International Trader occupies another 150% of warehouse space in Tri-City, Poland

AXI IMMO again advises Chemart International Trader in northern Poland