What will happened with rents on warehouse market? Will the rents rise?

The period of the greatest declines in effective rents is already behind us. According to the latest AXI IMMO’s report, transaction rents remain very low only in the case of very large contracts over 10,000 – 15,000 sq m. What can we expect in the forthcoming months?

The period of the greatest declines in effective rents is already behind us. According to the latest AXI IMMO’s report, transaction rents remain very low only in the case of very large contracts over 10,000 – 15,000 sq m. What can we expect in the forthcoming months?

Rents for warehouse space in 2016

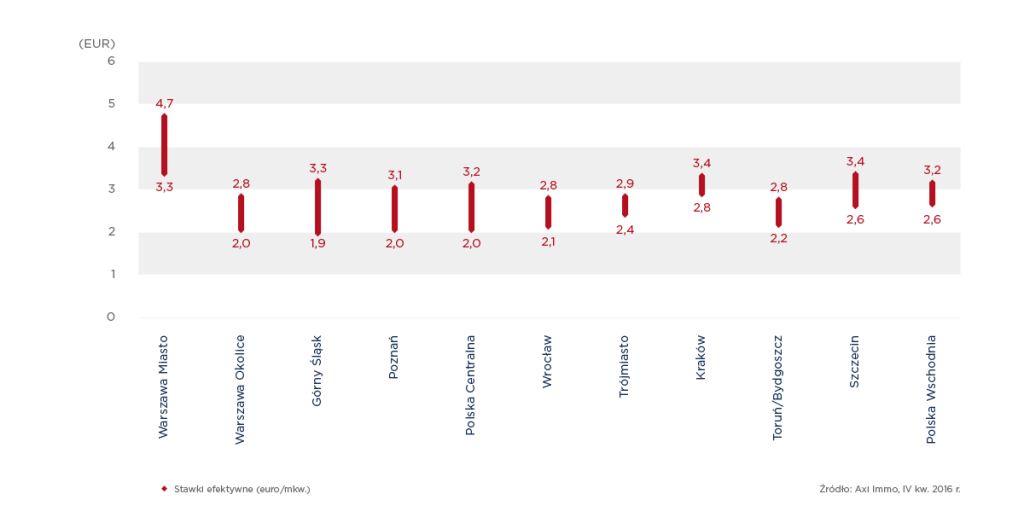

In 2016 the most attractive effective rents were obtainable in the Warsaw area (EUR 1.90-2.40/sq m) and in selected locations in Upper Silesia and Poznan. Rents for warehouse space remained low and stable in the regions because of the numerous projects under construction and competition between developers.

Quite high rates, within the range of EUR 2,50-3,20 sq m/month were found in Lodz and the Bielsko-Biala sub-region. Due to the small supply of investment plots and strong competition from other commercial sectors, Krakow is also one of the most expensive logistic hubs. The rents are keeping on a level above EUR 3.00/sq m in this location.

The rent for the warehouse in 2017 – Will the rents rise?

Renata Osiecka, Managing Partner at AXI IMMO, point out that the opportunity to negotiate rates depends on owner type and stage of the project. In most locations where existing facilities are managed through investment funds, the ability to negotiate rates below market averages is limited. It is different in the case of new facilities where the developer wants to have a pre-let agreement to start a new building or to close a project when the last unit remains free. In this case, the scope for rent holidays and financial incentives for tenants is generally larger.

In 2017 rents on the Polish industrial market are expected to remain stable. Currently, there are 1.3 million square metres under construction, of which 27% are speculative investments. This projects might limit pressure on increasing effective rental rates.

Further information about warehouse rents and Polish industrial market is given in the AXI IMMO’s report:

⇓ Industrial market in Poland – summary 2016 PDF|2 MB

Recent articles

15 April 2024

UNIQ LOGISTIC stays in Kutno, AXI IMMO real estate agency advises

UNIQ LOGISTIC stays in Kutno, central Poland, in the Kutno Logistics Centre. The tenant was advised by AXI IMMO

27 March 2024

MR D.I.Y. advised by AXI IMMO rents a warehouse at Hillwood Zgierz I, Central Poland

Almost 5,000 sq m for the logistics headquarters of MR D.I.Y. in Central Poland

12 March 2024

The latest AXI IMMO report: Industrial Market in Poland 2023

The Industrial market in Poland in 2023 – slower, but not weaker

4 March 2024

Chemart International Trader occupies another 150% of warehouse space in Tri-City, Poland

AXI IMMO again advises Chemart International Trader in northern Poland